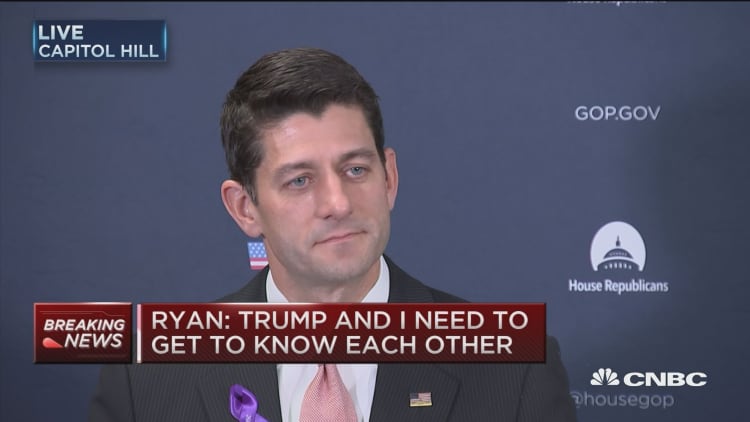

Any more misses in retailers' earnings Thursday could stir up bigger concerns about the consumer, but market focus may tilt toward politics — as Donald Trump meets with Speaker of the House Paul Ryan.

"I don't think it's going to be a back-breaker if they don't get along, but I think the path the election has taken has soured consumers' moods in general. The discord, the uncertainty, the fighting, the lack of overwhelming support for any one candidate is cause for a little bit of concern. Not a lot, but it's enough to dampen moods a little," said Anthony Valeri, investment strategist at LPL Financial. "This is a second, maybe third-tier factor on investors' minds."

Ryan has said he is not ready to support GOP candidate Trump. But ahead of the meeting, Ryan said he is hoping to help unify the Republican party. Trump and Ryan are far apart on many issues including austerity and debt. Valeri said if it looks like Ryan and Trump could share some policy in common, it would give investors more confidence in the Republican side of the race.

"With Trump becoming the presumptive nominee, I think that throws in another wrinkle of uncertainty. Not much is known about his policy view," said Valeri. "I think there's major questions about either candidate — Clinton or Trump, and I think that's weighing on investors' minds." The meeting starts at 9 a.m. EDT and will also be attended by Republican National Committee Chairman Reince Priebus and Senate Majority Leader Mitch McConnell.

Art Cashin, director of floor operations at UBS, said the presidential race is not yet moving the market, but the Trump-Ryan meeting is important. "How that comes out and how plausible his candidacy looks will begin to be a focus. It will move closer to center stage," he said.

So far the bond market is not reacting to the idea of a Trump presidency, said Brian Rehling, co-head of global fixed income strategy at Wells Fargo Investment Institute. "The market has not really reacted at all to the potential of Trump actually winning the presidency. Either that or the market does not believe with much seriousness that he would follow through on any of this talk about printing more dollars or any of the more extreme views that he's put out there," said Rehling.

Wall Street believes that Hillary Clinton will ultimately win the White House. Bespoke, in a note Wednesday, pointed out that when the Iowa Electronic Markets odds for the Democratic president rise or fall, so does the S&P 500.

It said when Democrats lost ground in January, so did stocks. The Democrats bottomed on Feb. 5, and the S&P 500 bottomed six days later, Bespoke noted. From Thursday though the weekend, Democrats were on the rise, and the market gained as well with a big rally Tuesday.

But stocks were clobbered Wednesday, with the Dow down 217 points at 17,711 and the S&P down 19 at 2064. Retail plunged and the SPDR S&P Retail ETF XRT was down 4.4 percent in its worst day since August 2011. Macy's was the latest retailer to disappoint with worse than expected sales and a negative forecast.

Macy's reported a shocking 36 percent decline in operating earnings, but its executives attempted to reassure analysts about the health of the consumer.

"Clearly our industry is in something of a rough patch ... but the consumer seems to be doing OK," Macy's CFO Karen Hoguet said on a call with analysts. "It's reasonable to conclude that the consumer will return to more aggressive discretionary spending at some point, hopefully sooner than later," she added.

Disney was also a drag after its first earnings miss in five years. A more than 3 percent rally in crude on a surprise draw in inventories failed to help the broader market.

On Thursday, Kohl's, Ralph Lauren and Party City report before the bell, while Nordstrom reports after the closing bell. All will be watched by traders who are trying to glean whether the series of negative retail forecasts this week are the result of downshifting consumers or more specific to the problems of brick and mortar stores.

"I think people are now seeing it as a collective train wreck," said Cashin. "It was just an apparel problem, but now that you're in Macy's and super stores, it just seems like there's too much retail around. People are going to have to start closing stores and get smaller." Cashin said in the slow-growing economy, consumers also appear to be making a choice for entertainment over shopping.

Read MoreThis so-called safe trade may now be very dangerous

Valeri said he believes the retailers are suffering from a broader malaise affecting consumers.

"What makes this difficult is that the news from Amazon.com is good but a lot of retailers see mixed to weaker results," he said. He added that the stock market could struggle until it sees a positive catalyst.

"We need to see some of the top-tier [economic] indicators show renewed strength, and the second would be the signs that earnings are improving," he said. Valeri said he sees earnings improvement in the second half but profits are still expected to be an issue in Q2.

In the Treasury market, traders were taking note of another strong government auction, with $23 billion in 10-year notes seeing strong demand from foreign buyers. The notes were sold with a yield of 1.71 percent. "It was a good day just with the equity market selling off. People were obviously looking to take some risk off the table," said Rehling.

Read MoreThe Fed never anticipated low rate impact on financial sector: Fisher

"The market doesn't think the Fed's going to raise rates much," said Rehling. "I don't think the market thinks the economy is doing terribly. It's just not doing very well."

Rehling said the most important economic headlines for the market this week come on Friday when retail sales and PPI producer price inflation data are reported. Thursday's data includes weekly jobless claims and import prices, both at 8:30 a.m. EDT.

The Treasury market is also watching issuance in the corporate debt market, where it is shaping up to be a $50 billion week. Informa Global Markets said there was $7.8 billion in investment grade debt issued Wednesday, for a total of $41.8 billion for the week so far.

Read MoreThis is where you should stash your cash right now

"There's tons of demand for high quality debt. I don't think you can get too much supply," said Rehling. "When you get into lower quality paper, it's a different story. For the high quality paper, there can't be enough of it … investors are looking for duration as well. … There's a lack of supply out there."

Besides retailers, other companies reporting earnings include Nissan, Vimpelcom and Dr. Reddy's Laboratories. After the bell, American Renal, Shake Shack and Red Rock Resorts report.